You've worked hard and paid a lot to get your Ontario Real Estate license, and there is no reason to give that up.

We help agents across Ontario to keep their options open.

Karma Realty Inc. offers Real Estate License Parking services to Ontario Real Estate Sales Representatives and Brokers.

If you are leaving the business temporarily or permanently due to:

- Retirement

- Maternity Leave

- Illness

- Caring for an aging parent

- Travel

- You are a recent course graduate and not ready to start

- Any other purpose

It shouldn't cost you all your hard-earned savings.

By parking your license with us, you can:

- Keep your license so that you keep your options open

- Refer past clients, friends and relatives and collect the referral fee

- Move to Active selling again easily

- Be kept informed of industry changes

- Be notified of due dates for education and insurance

- Get a referral fee for any Sales Representative or Broker that you send to us

Karma Realty Inc. is not a member of the Canadian Real Estate Association (CREA), The Ontario Real Estate Association (OREA) or any other board. Registrants who park their license with us are still licensed Real Estate Representatives under the Real Estate Council of Ontario (RECO).

If you want to be able to do referrals and have the ability to re-instate your license, and pay a minimum for these benefits, then you have come to the right place.

It's not a difficult process, and we can walk you through every step.

Sign up to park my Ontario Real Estate license now!

Home sales recover in August

- Details

- Karma Realty

According to the Ontario Real Estate Association, home sales in Ontario continued to recover in August. Sales activity reported was up 6% from the August 2018. The average home price was also up 6%. On a year to date basis sales were up 7.1%

For more information see the CREA / OREA news release.

If a active market hasn't improved your activity and you are considering your options, contact us to see how we can help!

TREB: GTA home sales drop 16% in 2018

- Details

- Karma Realty

TREB has reported that a total of 77,426 residential transactions were processed by TREB's MLS® System in 2018. This represents a 16.1% drop in sales reported in 2017. The Toronto Real Estate Board also noted that total new listings entered into TREB's MLS® System were down by 12.7 per cent over the same period to 155,823.

Although the average price was up slightly, this is attributed to an increase in price of sales of condominium apartments within Toronto.

For more information, see the TREB news release

If a slowing market is making you consider your options, contact us to see how we can help!

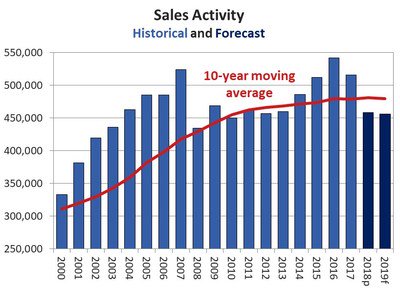

CREA forecasts Home Sales to fall to 9 year low in 2019

- Details

- Karma Realty

Blaming both rising interest rates and tougher mortgage rules, CREA predicts that next years sales will fall to a nine-year low. However, CREA also believes that the average home sale price will rise a bit less than 2 percent.

While we expect sales activity to stabilize next year… we nevertheless anticipate that prices will slow even further to gains likely below that of inflation.- Canadian Real Estate Association

For more information, see the CREA News Release

If a slowing market is making you consider your options, contact us to see how we can help!

CREA says Home Sales fell over the last 3 months

- Details

- Karma Realty

Home sales fell again for the third month according to CREA with Toronto and Vancover leading the way.

Sales are down across the province, with the GTA and Hamilton-Burlington showing the biggest drops. CREA predicts that home sales will fall double digits to their lowest in five years.

“ The decline in homeownership affordability caused by this year’s new mortgage stress-test remains very much in evidence. Despite supportive economic and demographic fundamentals, national home sales have begun trending lower. ”

~ Gregory Klump, CREA Chief Economist

For more information, see CREA Stats

If a slowing market is making you consider your options, contact us to see how we can help!